Roth IRA vs. Traditional IRA: Which Retirement Account is Right for You?

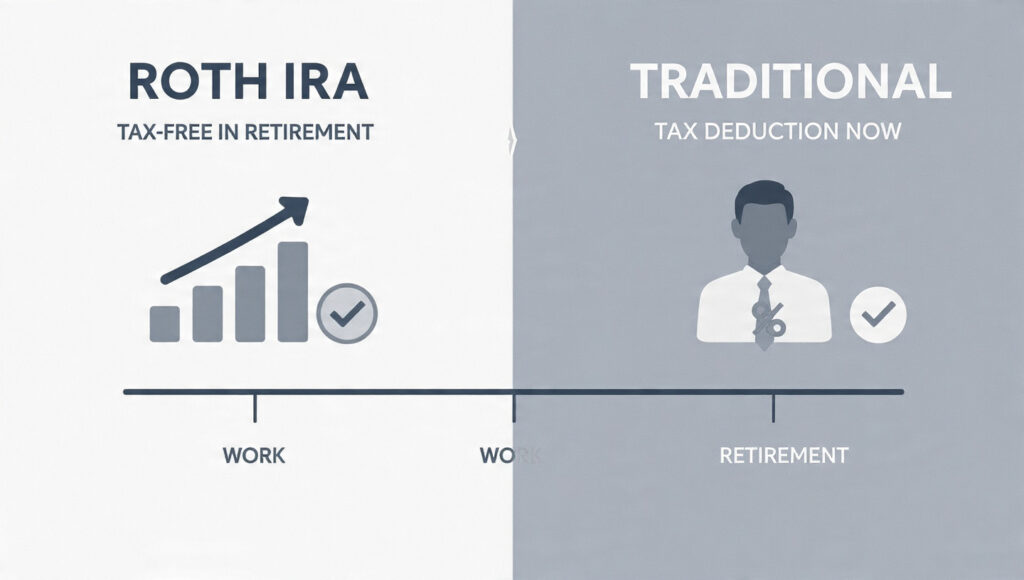

Choosing between a Roth IRA and a Traditional IRA is one of the most important retirement decisions you’ll make. Both accounts help you invest for retirement, but they differ fundamentally in how and when you pay taxes. This guide compares Roth IRA vs. Traditional IRA in plain terms, using real scenarios to help you decide which account aligns with your income, tax bracket, and long-term goals.

Key Takeaways

- Roth IRAs are funded with after-tax dollars and offer tax-free withdrawals

- Traditional IRAs provide upfront tax deductions but taxable withdrawals later

- Contribution limits are the same, but eligibility rules differ

- Required minimum distributions apply only to Traditional IRAs

- The best choice depends on your current vs. future tax rate

What a Roth IRA Is

A Roth IRA is a retirement account funded with after-tax money. You don’t get a tax deduction when you contribute, but your investments grow tax-free—and qualified withdrawals in retirement are also tax-free. Core characteristics

- Contributions made with taxed income

- No taxes on qualified withdrawals

- No required minimum distributions during your lifetime

Cause → effect → outcome

Pay taxes now → tax-free growth → predictable retirement income with no tax bill.

What a Traditional IRA Is

A Traditional IRA is funded with pre-tax money in most cases. Contributions may be tax-deductible today, but withdrawals in retirement are taxed as ordinary income. Core characteristics

- Potential upfront tax deduction

- Tax-deferred growth

- Required minimum distributions starting at age 73

Cause → effect → outcome

Lower taxes today → deferred taxation → taxable income in retirement.

How Taxes Differ: Roth IRA vs Traditional IRA

Taxes are the defining difference between these two accounts.

Roth IRA taxes

- Contributions: taxed now

- Growth: tax-free

- Withdrawals: tax-free (qualified)

Traditional IRA taxes

- Contributions: often tax-deductible

- Growth: tax-deferred

- Withdrawals: fully taxable

If your tax rate is higher now than it will be later, a Traditional IRA often makes sense. If your tax rate is lower now than in retirement, a Roth IRA can be more powerful.

Contribution Limits and Eligibility (2025)

Both IRAs share the same contribution cap but differ in eligibility.

Contribution limits

- Up to $7,000 per year

- $8,000 if age 50 or older

Roth IRA income limits

- Eligibility phases out at higher incomes

- High earners may be restricted or excluded

Traditional IRA income rules

- No income limit to contribute

- Deductibility may phase out if covered by a workplace plan

These rules make Traditional IRAs more accessible, but Roth IRAs more valuable when available.

Required Minimum Distributions and Flexibility

Traditional IRA

- RMDs are mandatory starting at age 73

- Withdrawals increase taxable income

Roth IRA

- No RMDs during the owner’s lifetime

- Greater flexibility for estate planning

This difference alone makes Roth IRAs attractive for long-term and legacy planning.

Real-World Scenarios: Which IRA Fits Best

Roth IRA may be better if

- You’re early in your career

- You expect higher income later

- You want tax-free retirement income

Traditional IRA may be better if

- You’re in a high tax bracket now

- You want immediate tax savings

- You expect lower retirement income

Combination strategy

Many investors contribute to both to create tax diversification, giving flexibility in retirement withdrawals.

Common Mistakes to Avoid

- Choosing based on current income only

- Ignoring future tax brackets

- Forgetting RMD rules

- Assuming one option is “always better”

Retirement planning works best when tax rules are considered across decades.

Frequently Asked Questions

Can I have both a Roth IRA and a Traditional IRA?

Yes. You can contribute to both, as long as total contributions stay within limits.

Which IRA grows faster?

Growth rates depend on investments, not the account type. Taxes determine what you keep.

Is a Roth IRA always better for young people?

Often, but not always—income trajectory and tax law matter.

Are Roth IRA withdrawals always tax-free?

Only if requirements for age and holding period are met.

Can I convert a Traditional IRA to a Roth IRA?

Yes, but taxes are owed on the converted amount.

Action Steps

- Estimate your current and future tax brackets

- Check Roth IRA income eligibility

- Decide whether upfront deductions or tax-free withdrawals matter more

- Consider using both accounts strategically

- Review annually as income and tax laws change

Conclusion

When comparing Roth IRA vs. Traditional IRA, the right choice comes down to when you want to pay taxes. Roth IRAs favor future flexibility and tax-free income, while Traditional IRAs offer immediate tax relief. Many U.S. investors benefit most from using both over time, balancing today’s savings with tomorrow’s certainty.

External References

- Internal Revenue Service — IRA Contribution Rules

- IRS — Required Minimum Distributions

- Vanguard — Roth vs Traditional IRA Guide

- Investopedia — Roth IRA vs Traditional IRA